The study of search, be it by people like David Stark in sociology, or economists or others, I tend to sort of see it in the tradition of a really rich socio-theoretical literature on the sociology of knowledge. And as a lawyer, I tend to complement that by thinking if there’s problems, maybe we can look to the history of communications law.

Archive

Neoliberalism is broken. The economic model of the last thirty years. It worked for a bit, dragged the bottom two thirds of the world’s population up the income scale dramatically, facilitated the tech revolution. But it’s stopped working.

For me a city…is a complex but incomplete system. And in that mixity of complexity and incompleteness lies the capacity of cities to have very long lives. Much longer lives than very powerful corporations, which often are very closed systems.

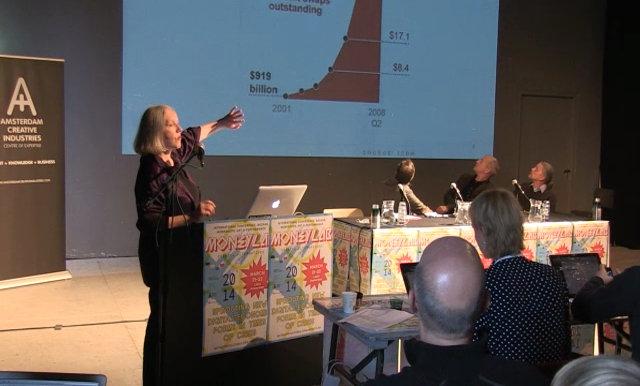

I think one first step is to distinguish between traditional banking, which sells money it has (or it can borrow very quickly, whatever) and finance, which sells something it does not have. And in that selling what it does not have lies its creativity. It has to invent instruments. And secondly—and they go together—it has to invade other sectors. Because it itself does not have what it needs to produce.

I actually think you can trace many many of these big systemic crises to being symptoms of the flawed idea that economic growth can go on indefinitely, exponentially, on a finite planet. That’s sort of my North Star. And then as a finance person, why do we think we need economic growth? Well, because the way our capital system works is that capital demands that growth.

I was at a party one time where I was talking to some guy who had been profiled by Adbusters because he was a big climate change guy. And he basically told me…that I needed to be making my own food, I needed to be making my own clothes. So you’re telling me that as a working mother going to school full-time, along with those responsibilities in which I am at home studying most the time, I should be making my daughter’s clothes. I should be whipping up meals from scratch. Um…no.

We know very little about complex financial systems and how systemic risk, as it’s called, is computed and how you would manage policies. And if you look back at the financial crisis, you can either say, as many economists do, “It all had to do with badly-designed rules,” which may be part of the story; it’s certainly part of the story. Or it may have to do with the interaction of those rules and human nature, like mortgage broker greed, optimism… And you see it not just in individuals who now have houses and foreclosure, but at the highest levels.